This Earth Day, put our planet over plastic

The United States is the world's largest plastic polluter: Every year, we produce a staggering 35 million tons of plastic waste. PIRG is working to fix that -- and we need your help.

PIRG is an advocate for the public interest. We speak out for the public and stand up to special interests on problems that affect the public's health, safety and wellbeing.

The Latest

New report: 300-plus food recalls in 2023, highest since 2020

ADVISORY: Lawmakers from across U.S. to expose how tech lobbyists hurt your ability to keep data private

Updates

The fourth meeting on the United Nations global plastic treaty happening this week

To U.S. Trade Representative: We must reduce, reuse, repair and recycle critical minerals

Energy Conservation & Efficiency

Clean lighting bill clears Illinois House

Trash talk: How students can tackle fast fashion

Join our webinar to learn about how to run your own campus campaign to target fashion waste and push the fashion industry to become more sustainable.

VIRTUAL

Zoom

Food for Thought 2024

More than 300 food products were recalled in 2023 as a dozen outbreaks sickened 1,100 and killed 6

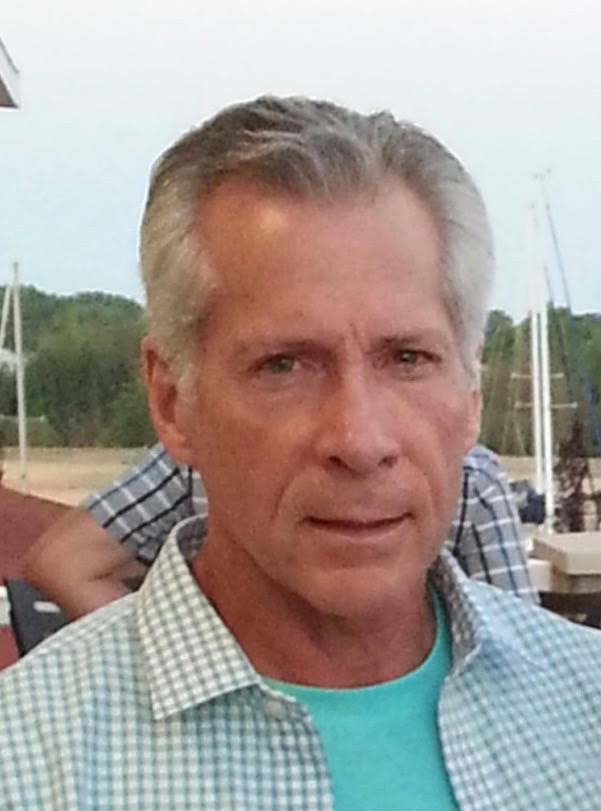

I like that PIRG digs down and finds ways the system has been rigged against our long-term welfare and tries to translate that into legislative and legal action at the state, local and national levels.Nick Bridge, Member

PIRG will keep working until the job’s done

When I buy something, I think I own it. I don't want to have to ask anyone's permission to open it up and try to fix it.

We need to stand up to companies that profit when we throw stuff away

As there is ever more to be done, I like that WashPIRG works to solve important issues while educating the public about them, and is playing an active role on many fronts.Frank Kroger, Member

Solving important issues while educating the public

I decided to support an organization that doesn’t seem to rely on partisan politics to accomplish goals, and as a pediatrician, I have been especially interested in OSPIRG’s projects that impact the health of children and infants...Patricia Jett, Member

I decided to support an organization that doesn’t…rely on partisan politics to accomplish goals

Today, I can see that sustainable fashion holds immense power. It's a transformative force that holds the key to transitioning towards a regenerative world, where social, environmental, and climate justice are not just aspirations but reality.Claudia Castanheira, Socioenvironmental Communicator, Writer, and Independent Researcher for Fashion Revolution Brazil & Belgium