Panama Papers Tie Mega-Donors to Offshore Tax Loopholes

We always knew that the big money pouring into this year's election wasn't coming from everyday Americans, but new reports reveal ties to offshore tax dodging.

We always knew that the super PAC funds pouring into this election weren’t coming from everyday Americans. Last month, one report revealed that just 50 political contributors have provided nearly half of the funds raised by super PACs in the 2016 election. But a new analysis of the Panama Papers shows the problem is even worse than we thought—wealthy individuals are shaving billions of dollars off their taxes through offshore loopholes and using this money to finance political spending.

In April, 11.5 million files from an offshore law firm were leaked to the media in a scandal called the Panama Papers—the largest document leak in history. This event was jaw-dropping due to the fact that, while not all of the transactions and accounts arranged by the firm were illegal, many helped extremely wealthy individuals dodge billions of dollars in taxes through the use of offshore “shell” companies and other methods. Among these wealthy individuals and corporations are some of the top mega-donors funding this year’s political campaigns.

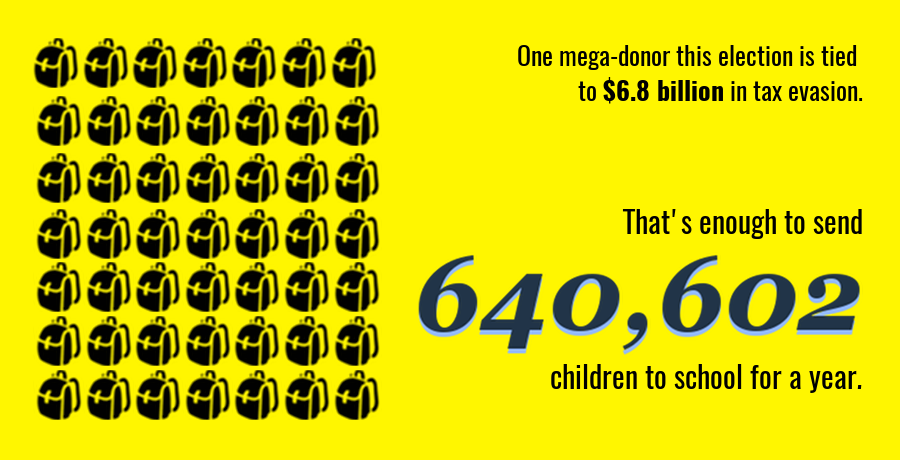

Renaissance Technologies, a hedge fund exposed in the Panama Papers, donated $13 million to Ted Cruz’s campaign and $2 million to Hillary Clinton’s campaign. Investigations of that firm now suggest that it saved $6.8 billion through the use of tax loopholes over a decade.

That has big consequences for our political system. The individuals and corporations our lawmakers turn to for support, the mega-donors they meet with, and the millionaires who fund their election have fundamentally different policy priorities than average Americans. While many students and their families worry about college tuition and taxpayers work to balance their checkbooks, the mega-donors funding our elections have made offshore loopholes a top priority.

Meanwhile, everyday Americans pay their fair share in taxes, but can’t afford to cut thousand dollar checks to the candidates they support. The end result is a Congress that cares more about helping Wall Street than protecting struggling families.

This month’s discovery that political mega-donors have saved $6.8 billion through offshore tax dodging isn’t just big, it’s truly staggering. Let’s put the numbers in perspective: $6.8 billion is about enough money to send 640,602 American children to public school for a year. It’s enough to provide around 680,000 Americans with healthcare. Instead, mega-donors and special interests are able to save those funds through offshore loopholes and then use their savings to spend big on our elections.

It doesn’t have to be this way. One new idea is making its way around Washington, D.C., that could put American taxpayers in control of our democracy. It’s called the small donor tax credit.

Today, around 122 million adult Americans pay federal income taxes. With a small donor tax credit, each of those taxpayers could direct the first $100 of their tax bill to the candidate of their choice. Even if just 10 percent of taxpayers took advantage of the small donor credit, they’d raise $6.1 billion for the candidates they support—more than the combined fundraising of every super PAC in our last presidential race.

That kind of money would turn today’s broken campaign finance system on its head. With a small donor tax credit, candidates would be motivated to listen to every American voice equally and focus their campaigns on raising money from ordinary taxpayers rather than mega-donors.

Last Congress, members of both parties introduced similar legislation, and as voters this year focus new attention on the issue of money in politics, a small donor tax credit has a real opportunity to break congressional gridlock. Let’s not miss our chance — take action now by signing the petition for a small donor tax credit.