How To: Using the CFPB’s Consumer Complaint Database

Since June 2011, the Consumer Financial Protection Bureau (CFPB) has been getting results for consumers by allowing them to file complaints about a variety of financial products and services. The complaint process has helped thousands of consumers settle disputes with their banks and lenders. Many of these consumers obtain tangible relief through the process.

Since June 2011, the Consumer Financial Protection Bureau (CFPB) has been getting results for consumers by allowing them to file complaints about a variety of financial products and services. The complaint process has helped thousands of consumers settle disputes with their banks and lenders. Many of these consumers obtain tangible relief through the process.

In addition to the complaint process itself, the CFPB helps consumers by maintaining complaint data in the Consumer Complaints Database. Consumers who are shopping around for financial products can use this database as a tool for reviewing issues that other consumers had in their area. Others who are having a problem with their bank or with a particular service might be able to review how similar complaints filed with the CFPB were closed.

Here are some steps to help you use the database:

- Let’s say, for example, that I’m having a problem with overdraft fees on my checking account at TCF National Bank. Before I file my complaint, I’m curious to see if other consumers have complained about similar issues at the bank. First, I need to visit the database here.

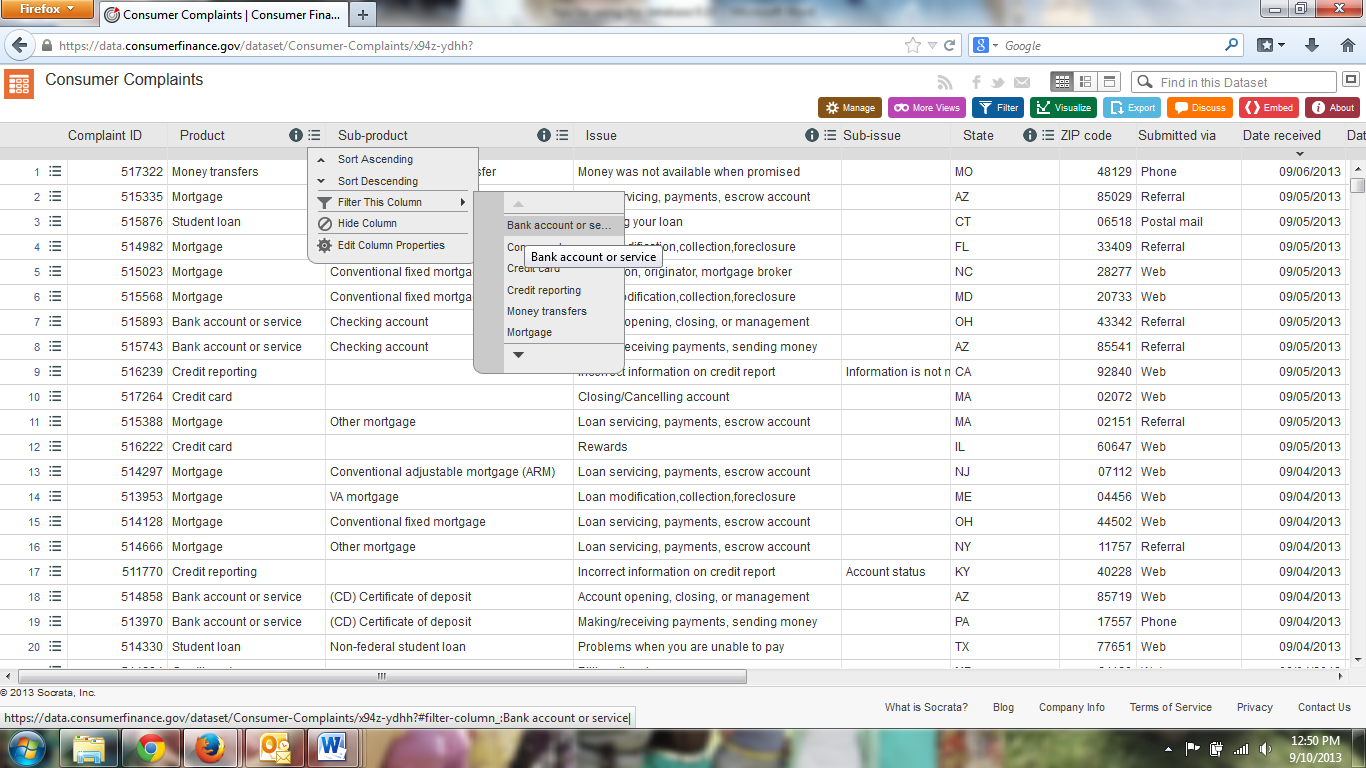

- First I want to filter the data just to show me complaints about bank accounts. I look in the ‘Product’ column and click the ‘Menu’ button to get the option to ‘Filter This Column’ and select ‘Bank account or service.’

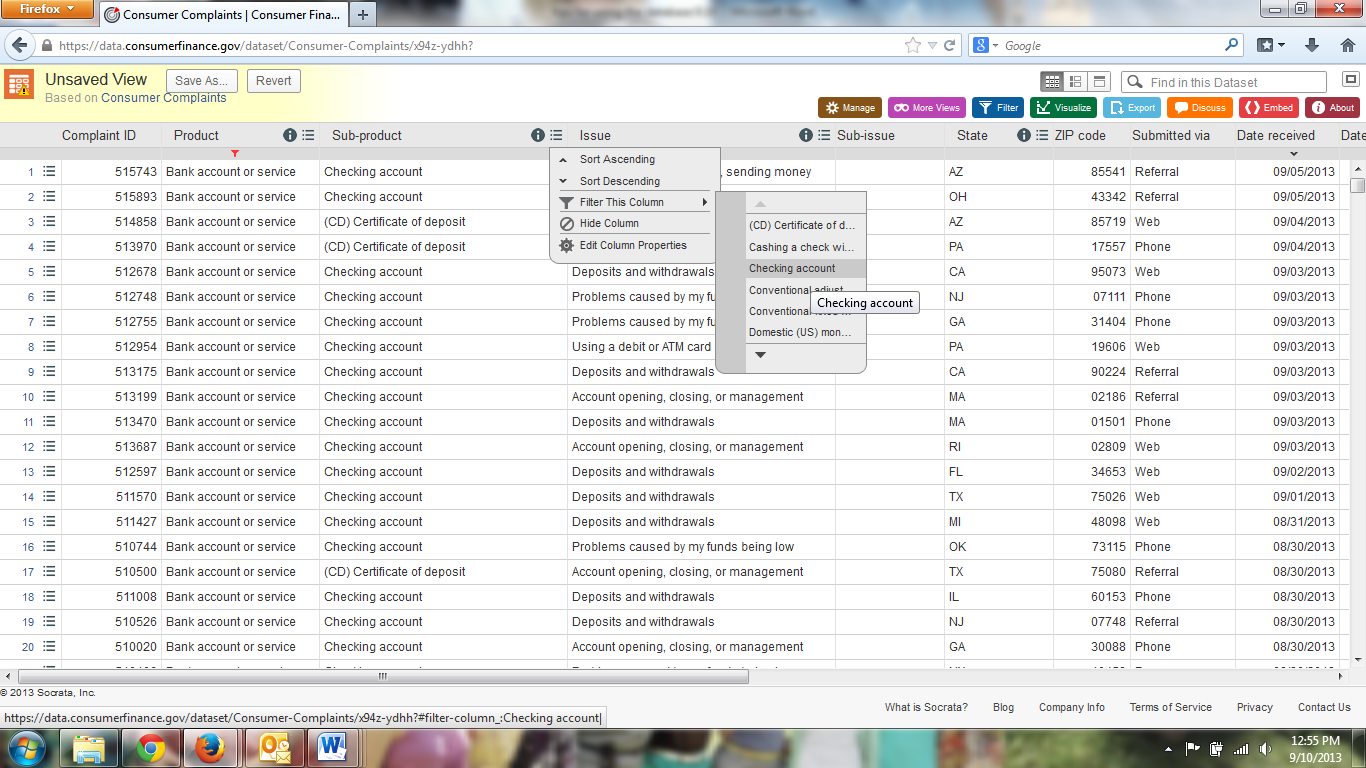

- Now that I am only looking at bank account complaints, I want to filter the data some more so that I am only looking at complaints about checking accounts. I repeat the filter process in the ‘Sub-product’ column and select ‘Checking account’.

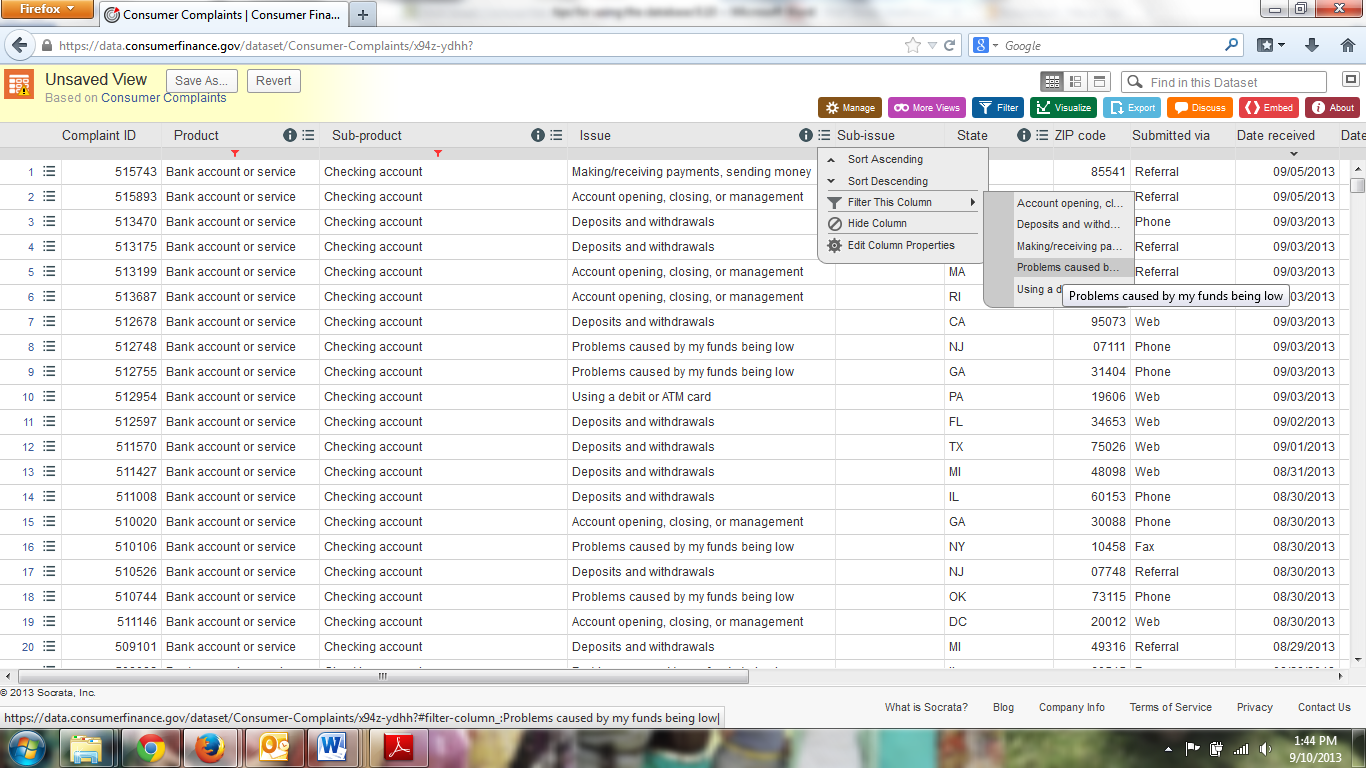

- From here I look in the ‘Issue’ column to see what type of complaint best describes my problem with overdraft fees. I select ‘Problems caused by my funds being low’.

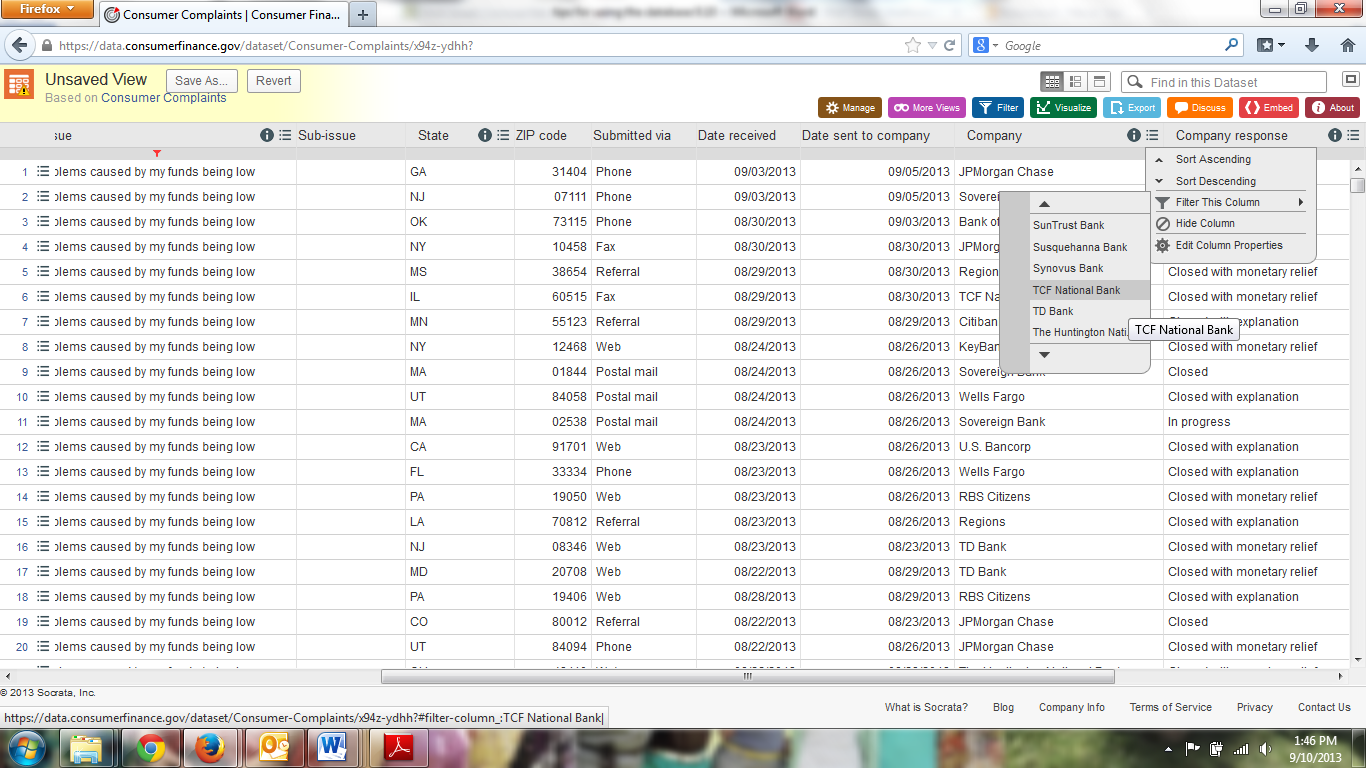

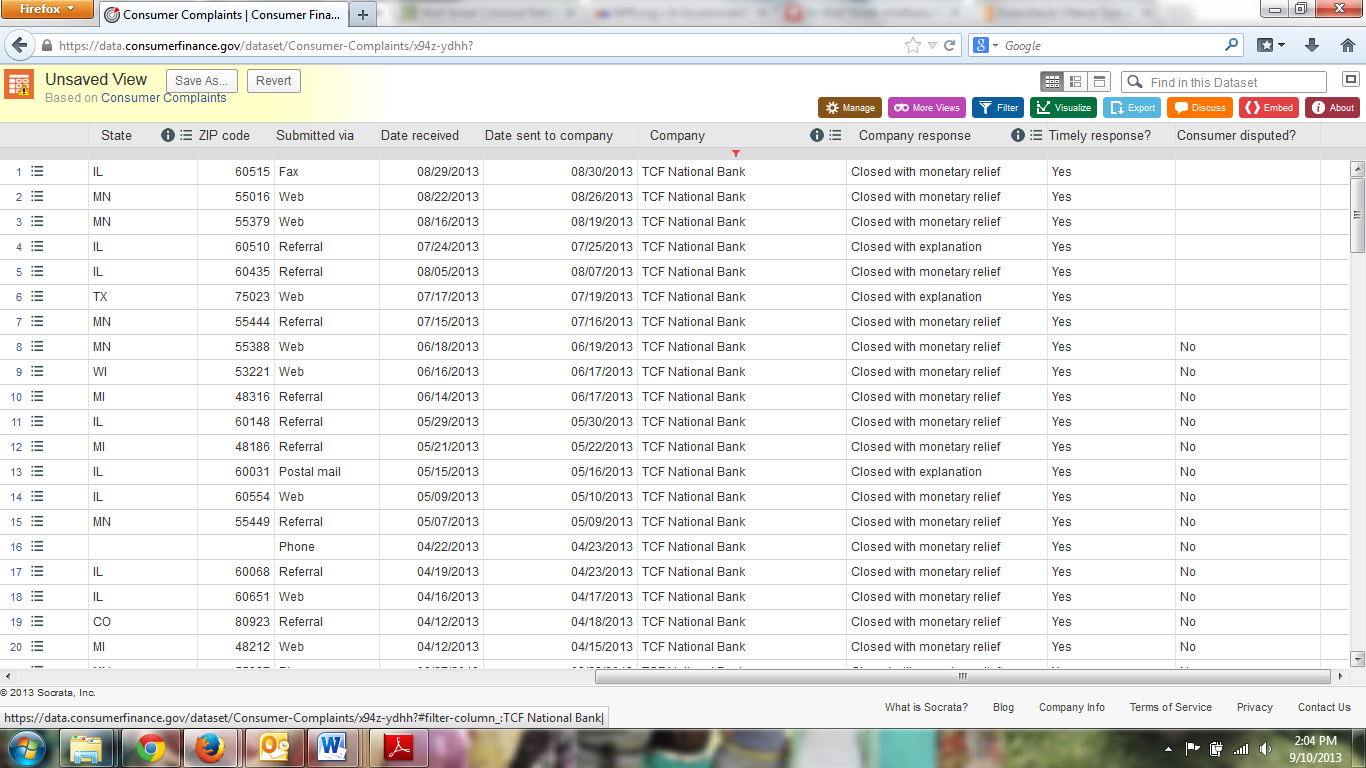

- Finally, I want to just see what complaints might come up for my bank, TCF National Bank. So I scroll to the right, find the ‘Company’ column, and select ‘TCF National Bank’.

- Now I can see the other complaints consumers have filed with the CFPB about problems caused by funds being low in a checking account at TCF National Bank.

It seems like consumers have been steadily filing complaints on this topic for a year and a half, largely in Illinois. When I look in the ‘Company response’ column I see that the majority of the complaints have been ‘Closed with monetary relief’. This is a much greater share than what we found in our “Big Banks, Big Complaints” report, that approximately one in four complaints is usually closed with monetary relief. While the lack of complaint-level detail makes it hard for me to figure out exactly what type of problems other consumers had, it seems like I am not the only one with this problem!

After I file my complaint with the CFPB, I might use the database to shop around for a new checking account with a bank that generates fewer complaints about this type of problem. I can use the filters in the database to check out which banks generated the most complaints on this topic in my state, and watch out for banks generating too many complaints or with untimely responses.

For more tips on shopping around for a bank account, check out our ‘Beat High Bank Fees’ tipsheet.

Topics

Authors

Laura Murray

Find Out More

New airline travel protections for consumers: refunds, transparent fees and more

Car companies are sneakily selling your driving data

Apple AirPods are designed to die: Here’s what you should know