Crop Insurance: A Taxpayer Giveaway by Another Name

Just like other agriculture subsidies, the federal crop insurance program directs billions of taxpayer dollars to the biggest agribusinesses, with the payouts biased towards commodity crops that are often processed into junk food ingredients. The program directly subsidizes agribusinesses’ insurance premiums on coverage they would buy anyway, making it yet another way taxpayer dollars pad Big Ag’s profits

Crop Insurance: A Taxpayer Giveaway by Another Name

Just like other agriculture subsidies, the federal crop insurance program directs billions of taxpayer dollars to the biggest agribusinesses, with the payouts biased towards commodity crops that are often processed into junk food ingredients. The program directly subsidizes agribusinesses’ insurance premiums on coverage they would buy anyway, making it yet another way taxpayer dollars pad Big Ag’s profits. As the Senate debates the 2012 Farm Bill, it should make significant changes to this flawed program to prevent lavish subsidies from going to a mature, profitable industry.

ð Crop insurance is big money. In 2011, this program cost taxpayers an eye-popping $7.4 billion.[1] The payouts to agribusinesses increase at times, like now, when crop prices are high, just when the industry needs the help the least – a perverse outcome given that defenders of subsidies often argue that they’re needed to provide a safety net for farmers when times get tough.

ð Payments go to the biggest players. Nationwide, just 4.4% of farmers pocket 73% of the dollars handed out by the program – in line with the distribution for agricultural subsidies as a whole, where fewer than 4% of farmers get 74% of the payouts.

ð The dollars go primarily to commodity crops, including corn and soy. Agricultural subsidies overall are heavily biased towards corn and soy, commodity crops that are often processed into junk food ingredients – since 1995, $17 billion in taxpayer subsidies have gone to additives like high fructose corn syrup. It’s the same story when it comes to crop insurance: when it comes to the biggest players (those who received more than $250,000 in subsidies last year), corn is the number one recipient, and soy is number three – together accounting for 48% of payments to these recipients.

ð Giant agribusinesses are getting enormous taxpayer handouts. In the U.S. , 1,131 agribusinesses pocketed more than $250,000 each last year. That is a total of $282 million. One of the biggest recipient of crop insurance subsidies received $.1.7 million, for growing corn and soybean crops in 8 counties in Minnesota.

ð The Senate may double down on this flawed program. The Senate is currently considering reauthorizing these subsidies in the 2012 Farm Bill. Adding insult to injury, they’re also proposing the creation of a new subsidy program that would guarantee that big agribusinesses continue to enjoy their current record profits. This additional layer of corporate welfare will cost taxpayers $30 billion over the next decade.

[1]Sources: Environmental Working Group, Government Records Show Crop Insurance Subsidies Are a Boon to Big Farm Interests, May 31, 2012; USDA Census of Agriculture 2007; U.S. PIRG Education Fund, Apples to Twinkies, September 2011; Congressional Budget Office, Letter to the Honorable Debbie Stabenow, April 23, 2012.

Topics

Authors

Nasima Hossain

Find Out More

Expired: How date labels drive food waste and hunger

New report reveals widespread presence of plastic chemicals in our food

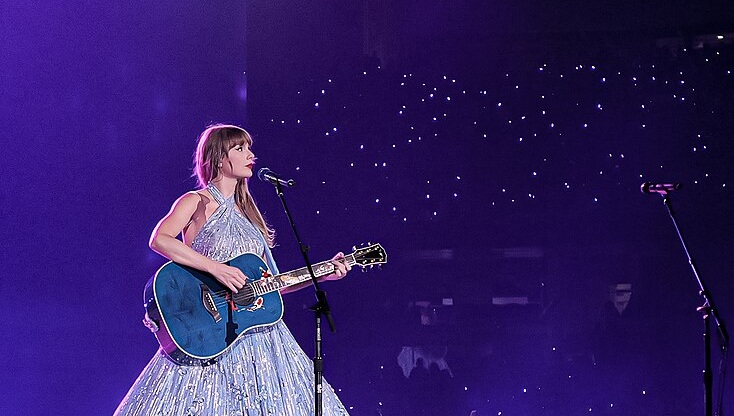

Taylor Swift albums as food waste reduction solutions